Reimagining Credit: Why Trinidad and Tobago Needs Alternative Credit Scoring

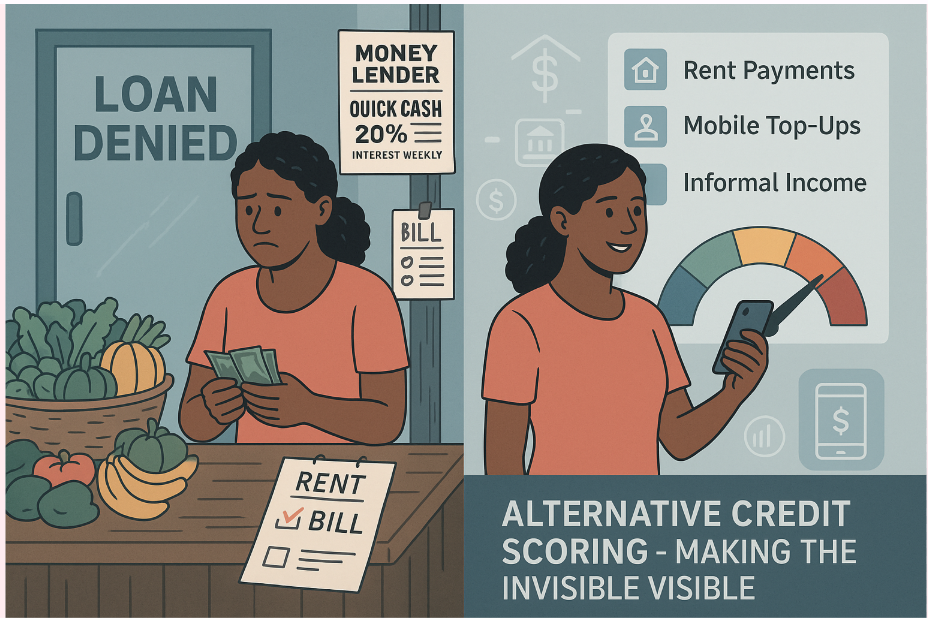

In Trinidad and Tobago, countless individuals are financially excluded, not because they’re irresponsible — but because the traditional credit system simply doesn’t reflect their reality. Consumers are often turned away from banks and credit unions because of rigid lending criteria, lack of collateral, or credit reports that fail to tell the whole story. Meanwhile, people turn to money lenders who charge exorbitant interest rates, or participate in sou sou (a traditional, trust-based savings circle). However, when informal schemes are mimicked and misused — as seen in the DSS (Drugs Sou Sou) scandal — many get hurt financially and emotionally, and consumer confidence erodes further. Add to this the errors financial institutions frequently make in reporting or assessing creditworthiness, and the case becomes clear: our current model is broken for many low- and middle-income consumers.

But there’s a promising alternative on the rise:

Alternative Credit Scoring

Instead of relying solely on formal credit history, alternative credit scoring looks at real-life behaviors to assess a person's creditworthiness. This includes:

-

Rent payment history

-

Utility and phone bill records

-

Mobile money usage and digital payments

-

E-commerce transactions

-

Employment from the informal sector (e.g., hairdressers, taxi drivers, market vendors)

Global Adoption and Impact

Countries and fintech innovators around the world are embracing this model to increase financial inclusion:

-

Kenya and Nigeria: Mobile lending apps like Branch and Tala use mobile phone usage and payment patterns to approve microloans.

-

India: Startups such as CreditVidya and Bharat Inclusion use alternative data to provide credit to millions without formal banking history.

-

European Union: The EU has supported digital finance projects that integrate open banking and alternative data to support credit decisions, particularly for underserved groups.

-

United States: Companies like Nova Credit and Petal use non-traditional data to assess immigrants, gig workers, and the unbanked.

Why It Matters for T&T

For thousands of consumers in Trinidad and Tobago, rent is paid on time, utility bills are consistent, mobile top-ups are regular — yet they remain invisible to lenders. By integrating alternative credit scoring, we can break this cycle. It can help:

-

Micro and small business owners access capital

-

Young adults build a credit footprint early

-

Informal workers get the recognition they deserve

-

Consumers escape predatory lending traps

-

Financial institutions expand their client base safely

This is not about charity — it’s about modernizing our financial ecosystem and giving everyone a fair shot at building their lives.

A Call to Action

To make this a reality, we need:

-

Policy reform that allows and encourages the use of alternative data in credit scoring

-

Consumer education on financial behavior and digital tools

-

Secure data collection systems that protect user privacy and require consent

-

Partnerships between fintechs, regulators, credit unions, and consumer advocates

At CAIR we are uniquely positioned to lead the charge. By promoting financial inclusion, running pilot programs, and engaging regulators, they can help design a system that’s truly built for the people.

Submitted by: C.Patrick

🔗 References for Global Examples of Alternative Credit Use

-

Branch International (Kenya, Nigeria)

https://branch.co/ -

Tala (Kenya, Philippines, Mexico, India)

https://tala.co/ -

CreditVidya (India)

https://www.creditvidya.com/ -

Bharat Inclusion Initiative

https://www.iiitb.ac.in/research-centres/bharat-inclusion-initiative -

Nova Credit (USA, supports immigrants)

https://www.novacredit.com/ -

Petal Card (USA, alternative data for credit cards)

https://www.petalcard.com/ -

European Commission – Digital Finance Strategy

https://finance.ec.europa.eu/publications/digital-finance-strategy_en

Contact CAIR today:

Subscribe to our blog and contact CAIR on any of our pages:

LinkedIn: https://www.linkedin.com/company/consumer-advocacy-and-information-resource/?viewAsMember=true

.jpg)

No comments:

Post a Comment